So Much For "Peak Oil?"

By: Lowell

Published On: 3/5/2007 8:02:30 AM

Based on this article in today's New York Times, it looks like the idea that world oil production is close to "peaking" may be wildly off base:

Based on this article in today's New York Times, it looks like the idea that world oil production is close to "peaking" may be wildly off base:

Within the last decade, technology advances have made it possible to unlock more oil from old fields, and, at the same time, higher oil prices have made it economical for companies to go after reserves that are harder to reach. With plenty of oil still left in familiar locations, forecasts that the world's reserves are drying out have given way to predictions that more oil can be found than ever before.

In a wide-ranging study published in 2000, the U.S. Geological Survey estimated that ultimately recoverable resources of conventional oil totaled about 3.3 trillion barrels, of which a third has already been produced. More recently, Cambridge Energy Research Associates, an energy consultant, estimated that the total base of recoverable oil was 4.8 trillion barrels. That higher estimate - which Cambridge Energy says is likely to grow - reflects how new technology can tap into more resources.

"It's the fifth time to my count that we've gone through a period when it seemed the end of oil was near and people were talking about the exhaustion of resources," said Daniel Yergin, the chairman of Cambridge Energy and author of a Pulitzer Prize-winning history of oil, who cited similar concerns in the 1880s, after both world wars and in the 1970s. "Back then we were going to fly off the oil mountain. Instead we had a boom and oil went to $10 instead of $100."

If this is true, if the whole concept of "peak oil" is faulty, there are enormous implications. For starters, it means that oil consumption - and the carbon emissions emanating from that consumption - can keep increasing for many decades to come. That's scary, considering the geopolitical implications (e.g., increased reliance on OPEC for the indefinite future). That's also scary considering that there are 118 billion metric tons of carbon contained in the "1 trillion barrels of heavy oil, tar sands, and shale-oil deposits in places like Canada, Venezuela and the United States."

How much carbon is that? In 2004, the world emitted 7.4 billion metric tons of carbon from the burning of fossil fuels. Which translates as follows: 118 billion metric tons of carbon is equal to 16 more years of carbon emissions at the 2004 rate. And that's just the carbon contained in heavy oil reserves. It does NOT count carbon contained in coal reserves, which are enormous, or in conventional crude oii reserves, which are also enormous. In other words, given the overwhelming scientific evidence that carbon emissions from fossil fuels are causing global warming, unless we choose not to consume all those fossil fuel reserves, the planet is screwed.

Fortunately, many people, cities, states and countries are now aware of this problem and are moving to do something about it. Unfortunately, they are not moving nearly fast enough, with the U.S. Energy Information Administration forecasting world carbon emissions to increase nearly 75% by 2030. The problem is, we need to be REDUCING carbon emissions not INCREASING them. Yet current policy actions taken by governments, even the Kyoto Treaty which the United States has never ratified, let alone implemented, barely even make a dent in the problem.

So here's the bottom line, the bitter pill to swallow: if we want to slow and ultimately stop global warming before we do horrendous damage to earth's ecosystems, we're going to need to transition rapidly away from a carbon-intensive economy. And barring a miraculous technological breakthrough in carbon capture/sequestration, that means we're going to have to slash our fossil fuel consumption - a lot less oil, a lot less coal, a lot less natural gas.

Can we do that? Theoretically, it's possible, but practically it's going to be very difficult without major government action. And by "major" I don't mean the tinkering around the edges we're engaged in now, I'm talking about a total national commitment to reducing fossil fuel consumption rapidly. How could that possibly be accomplished? Unfortunately, the most direct tool from an economics point of view would be a steep tax on carbon.

Imagine $5 or even $10 per gallon gasoline. Imagine winter heating bills many times what you pay now. Imagine a political non-starter, as in "no way in hell will Congress ever pass something like this." Which leaves only one other option: a crash program, along the lines of the Manhattan Project, to reduce fossil fuel consumption through energy efficiency and renewable energy sources.

So let's get moving, right? Seems like a no brainer, right? Well yes, but...we're simply not doing it. Even with Democrats in control of Congress, essentially nothing is happening. Do NOT listen to rhetoric from the Bush Administration, or from Democrats for that matter, that we are taking serious action on global warming. We aren't. No sense of urgency. No sense of leadership. No nothing.

In conclusion - and I hate to end on such a downer - I believe that we are in deep, deep trouble. Fossil fuel consumption and carbon emissions not only aren't peaking, they are increasing for the forseeable future. Say goodbye polar bears - and many other species. Say goodbye coastal cities. Say goodbye to a planet that we want to live on.

That's the direction we're heading, inevitably and powerfully, unless we get serious right now. And "geting serious" means no more talk of "peak oil," no more talk of "voluntary" efforts, and no more talk of growing enough corn to solve this problem. Until I stop hearing talk like that, I'll know one thing for sure - we are NOT moving to solve the problem of global warming. So much for "peak oil." So much for planet earth.

Comments

Sadly ... Yergin & NYTimes (A Siegel - 3/5/2007 8:33:11 AM)

are almost certainly wrong ... the major fields are all peaking. More oil is not coming out of the ground. And, the oil companies are sending out drills into deeper water, more dangerous places. And, by the way, they are not reinvesting their cash into oil -- they are investing as if they believe Peak Oil is a reality.

Yergin (CERA) has been ripped to shreds in recent months for the mediocrity of their work re Peak Oil. That Pulitzer prize is going a long way ...

Gotta disagree with you here, Adam (Lowell - 3/5/2007 8:38:14 AM)

1) The word "sadly" is completely backwards. What's sad is not that Yergin and the New York Times are "almost certainly wrong" but that they are almost certainly right. A world with practically unlimited fossil fuels means practically unlimited carbon emissions which means...disaster. Now THAT is what's sad.

2) As far as I can tell, and I worked at EIA for 17 years, almost no serious analysts believe in "peak oil," at least not the way it's portrayed by many "peak oil" enthusiasts. Yes, oil production will "peak" at SOME point. But will that point be a year from now, a decade from now, or a century from now? It makes all the difference in the world, and wishful thinking by environmentalists that oil is about to "peak" are simply avoiding the reality that oil - and more broadly, fossil fuels (the U.S. is the "Saudi Arabia of coal") are here to stay. For a LOOOONG time.

By the way, it's not just Daniel Yergin and CERA (Lowell - 3/5/2007 8:40:53 AM)

...it's also the US Energy Information Administration, the USGS, and most other analysts on this subject. Matt Simmons, of course, has raised questions about Saudi Arabia's oil reserves, but there is still no definitive evidence one way or the other on that question. As far as I can tell, the chances are at least as great that Saudi oil reserves are much HIGHER than the current "proven" number reflects, than that they are about to peak or even past "peak." Meanwhile, we've got those pesky trillion barrels of "unconventional" oil reserves that can be produced at $16 per barrel or so. So now what?

EIA -- The greatest failure of them all? (Don Wells - 3/5/2007 5:28:01 PM)

See Tom Whipple's essay of 2006-12-14 titled

"EIA -- The greatest failure of them all?" for a critique of EIA petroleum projections. The EIA's projections, which are based on absurd USGS reserves estimates made some years ago, are disastrously wrong. I say 'disastrously' because any US policy decisions which are based on the wrong-headed EIA thinking will put our country at risk. I recommend the

Hirsch Report as an antidote to the toxic EIA business-as-usual projections.

As you mentioned, EIA relies heavily on (Lowell - 3/5/2007 6:52:43 PM)

USGS reserve information for its world production forecasts. However my main criticism of EIA's forecasting methodology isn't that the oil reserve estimates are wrong, but that the production forecasts are generated backwards: first decide how much demand there's going to be at a particular price path, then figure out where the oil will come from to satisfy the demand. In my view, it should be a much more iterative process between supply, demand, and price. And price certainly shouldn't be determined first, but instead as an outcome of the supply/demand calculations. Also, there needs to be a lot closer "bottom up" look at each country to figure out what a reasonable production forecast might be. In previous forecasts, EIA has come up with some highly questionable long-term production forecasts for particular countries simply because those countries were assumed to supply whatever oil was demanded by world markets. That's not the way it works, in my opinion, although certainly demand and price increases can spur decisions by companies and countries to ratchet up their exploration and production.

Saudia Arabia declined 8% in 2006 - forest meet trees (MorrisMeyer - 3/5/2007 9:45:56 AM)

Lowell,

Here is a link to a site that discusses the CERA report

Here is a link to the statistics behind the Saudi Arabian decline

The earlier we mitigate and transition away from our oil dependency, the better we will be. Here is a graphic that shows how much of a challege that will be. We burn a Cubic Mile of Oil every year.

Finally, here is a link to the Climate Project presentation that I am giving at GMU this Wednesday. We'll talk about this, the science behind global warming as well as solutions - personal, community and political.

--morris

Morris Meyer

Democratic Candidate - House of Delegates 40th District

morris@morrismeyer.com

I agree that we need to transition from oil dependency (Lowell - 3/5/2007 9:53:53 AM)

and we need to do it fast. As far as Saudi Arabia is concerned, I wouldn't get caught up in month-to-month or year-to-year fluctuations in their oil production. That has nothing much to do with the issue of ultimately recoverable world oil reserves or world carbon emissions.

More nonsense from Yergin.... (ericy - 3/5/2007 11:40:04 AM)

There has been some interesting discussion recently over at www.theoildrum.com in relation to this. The most recent one was here:

http://www.theoildru...

A lot of people strongly suspect that the Saudi Arabia has already peaked and is declining. North Sea (Britain & Norway) have peaked and are declining. Mexico has peaked and is declining. Yeah, there are a number of projects that are slated to come online soon, but when you ask the question whether they will be able to offset declines, the answer is probably not.

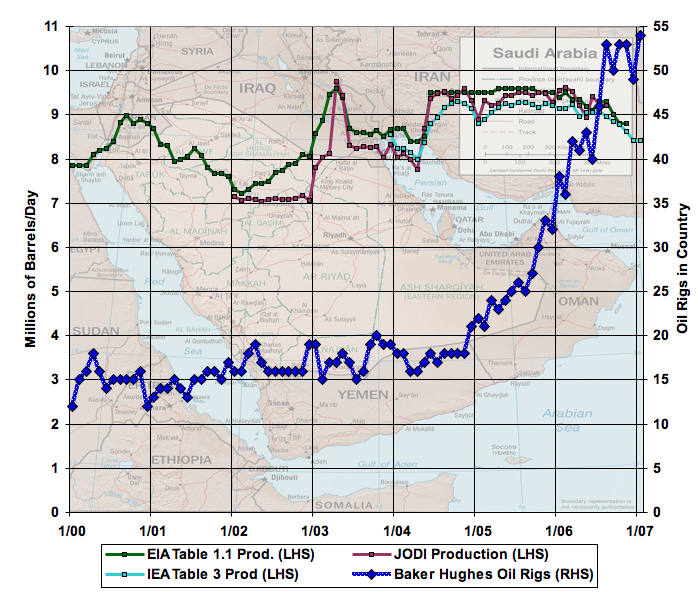

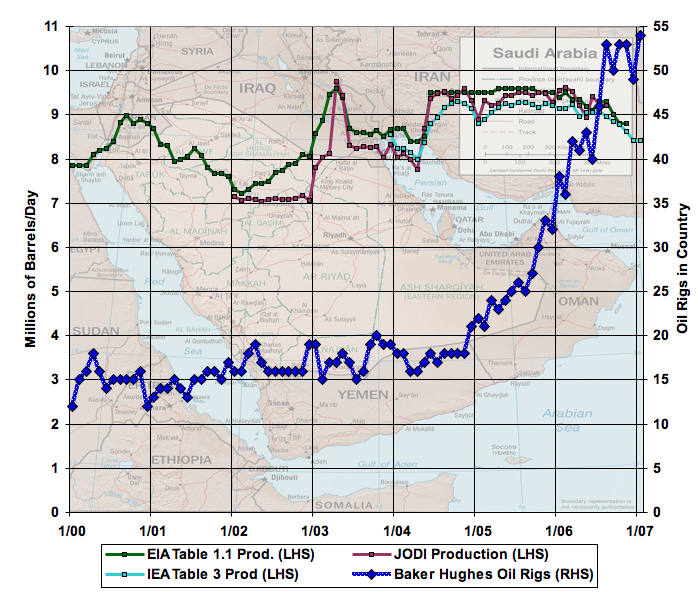

Here is a curve from theoildrum last week that starts to illustrate where things are now. This is production for *all* of OPEC (total world production runs about 85million barrels/day):

Note that the Saudis have announced several production cuts in recent months - they claim that there are no markets. Many suspect that the largest reservoir (Ghawar) in KSA has peaked and production is declining.

There are other graphs and curves in the discussion at theoildrum that show a huge increase in the number of drilling rigs in KSA:

so the declines in production show that despite heroic efforts to increase production elsewhere, overall production in KSA is still declining.

The huge question for the future is whether we go forward by burning dirtier forms of fuel (into this I would lump coal, tar sands and oil shale), or whether we take this opportunity to move forward rapidly with renewable forms of energy coupled with strong conservation.

Ultimately I am guessing that we are at a point where the seasonal demand for oil exceeds that which the world can supply in the summer when the demand is the highest. In the winter when demand is lower, I suspect that production can keep up. The outcome is that we will see wild price increases in the summer, and more moderate prices in the winter.

Well, I agree with this... (Lowell - 3/5/2007 1:42:22 PM)

The huge question for the future is whether we go forward by burning dirtier forms of fuel (into this I would lump coal, tar sands and oil shale), or whether we take this opportunity to move forward rapidly with renewable forms of energy coupled with strong conservation.

The first graph, however, simply shows seasonal fluctuations (on an axis that is highly distorting, by the way - put a ZERO based Y axis in there and see what this graph looks like!) and also OPEC's attempts to support prices at $60 per barrel. I've read Matt Simmons and I respect his analysis. However, this doesn't change the underlying fact that technology will allow for recovery of far more hydrocarbons as time goes by. That should be very troublesome for anyone, like me, who cares about the planet and also about our reliance on unstable, autocratic, "curse of oil" rentier nations.

Why is RK so pro-Big Oil (humanfont - 3/5/2007 2:40:16 PM)

I don't get it. First we have posts about how the price of oil couldn't have been manipulated around the election. Then we have comments about bio-fuels and alt energy being a fantasy. Finally we have a post about how peak oil doesn't exist; or is at least a long way off. Of course even if you believe that worldwide oil production hasn't peaked; US production has peaked and been in decline since the 1970s.

it's lowell (Josh - 3/5/2007 2:48:55 PM)

He's a well-documented expert on oil and energy policy, and this is his assessment of the situation. Whether or not you agree, Lowell is well-informed on the subject... just try to keep him from telling it as he sees it.

Btw, I think we're already at peak oil, or will hit it in the next 5 years, but I'm not an expert... I'm mostly a political economist.

Pro Big Oil?!? (Lowell - 3/5/2007 3:20:57 PM)

Have you been reading the same blog that I've been writing? If you haven't noticed, I do not like Big Oil one bit. However, that doesn't mean I'm going to buy into every crackpot conspiracy theory around, like "Big Oil is propping up oil prices to manipulate the elections." There's simply no EVIDENCE for that, no matter much I don't like ExxonMobil and friends.

As far as Peak Oil is concerned, I have consistently urged that we get off of oil as fast as possible. If Peak Oil is not near, then that means there is even MORE urgency to do so, because it's not just goin gto happen naturally.

As far as U.S. production is concerned, obviously it's been declining for decades, but what does that have to do with anything? It certainly doesn't matter to the polar bears whether the carbon was emitted from oil produced in the US, Russia, Saudi or Canada.

By the way, (Lowell - 3/5/2007 3:23:33 PM)

maybe there's someone who writes for RK who is "pro-Big Oil," I just don't know who they are. As far as I know, we're all strongly for pro-environment, pro-energy efficiency, and pro-renewable power. I personally try to consume as little oil as possible, by the way, by living near Metro and driving a Prius when I have to drive. How about you?

Bogus article (Todd Smyth - 3/5/2007 8:17:52 PM)

The peak oil projections take oil shale, oil sands and the other "new" sources into account. We peaked between 1970 and 1971, when new crude oil discoveries dramatically declined. We are on the back slope of peak oil now. The problem with the peak oil theory is that long before we drown from global warming or suffocate from our atmosphere being burned off, we will kill each other over the remaining petroleum. And it's already happening in Iraq, Sudan, Nigeria and soon Iran and Columbia.

BIOFUELS BABY!

The "new" sources are just as much (Lowell - 3/6/2007 6:50:24 AM)

hydrocarbons as the "old" sources. Also, if you read the article, you would have noticed that they were mostly talking about increased recovery of "old" oil still in the ground, not "new" sources of oil like Canadian tar sands.

Peak Oil Refers to Light Sweet Crude (wagonball - 3/6/2007 10:04:59 AM)

As an enginer who has some experience working in oil refiner I know the difference between Light Sweet Crude and everything else. Refiners like because is flows easily, does foul catalysts and costs alot less to refine. Oil producers like for the same reason.

We have or have nearly peaked production of light sweet crude int eh world. The largest untapped reservers are in IRAQ and will not put into production for quite some time.

Secondary and tertiary recovery methods for Light Crude are expensive enough but pale in comparison to producing Tar Sands on Canada or Heavy Oil in Venezuala. Not to mention the huge energy cost of making the steam needed to get this stuff to flow, keep fluid enough to pump, get it to the shippers and refine. This is all very bad news for the environment unless we can somehow trap and lock up all that extra carbon dioxide generated to get a gallon of gas to the market. This oil is not economically available unless light sweet crude is expensive enough. Judging the markets, the break point is probably around $50/barrel.

For those old enough, President Carter killed development of Oil Shale in Colorado because the devastating environmental implact of the extraction process. Think of the horror stories of all those old abandoned mineral mine in Colorado amplified 100 fold or more.

Based on this article in today's New York Times, it looks like the idea that world oil production is close to "peaking" may be wildly off base:

Based on this article in today's New York Times, it looks like the idea that world oil production is close to "peaking" may be wildly off base: