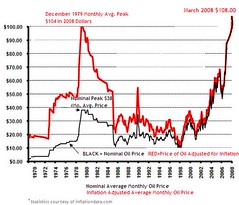

Back in March 2005, when I was still working as an international oil markets analyst at the US Energy Information Administration (and oil prices were about $50 per barrel), Goldman Sachs came out with its first "super spike" analysis.

Back in March 2005, when I was still working as an international oil markets analyst at the US Energy Information Administration (and oil prices were about $50 per barrel), Goldman Sachs came out with its first "super spike" analysis.

Oil markets have entered a ``super-spike'' period that could see 1970's-style price surges as high as $105 a barrel, investment bank Goldman Sachs said in a research report[...]

``We believe oil markets may have entered the early stages of what we have referred to as a ``super spike'' period -- a multi-year trading band of oil prices high enough to meaningfully reduce energy consumption and recreate a spare capacity cushion only after which will lower energy prices return,'' Goldman's analysts wrote.

Goldman Sachs took a lot of flak for that forecast at the time (a small minority of us at EIA, myself included, thought Goldman Sachs was right on), but in the end they turned out to be almost exactly right. Today, oil prices are surging above $120 per barrel, with no end in sight. And Goldman Sachs is out with a new super spike analysis:

Oil could shoot up to $200 within the next two years as part of a "super-spike" driven by poor growth in oil supplies, investment bank Goldman Sachs (GS.N: Quote, Profile, Research) said in a research note."We believe the current energy crisis may be coming to a head, as a lack of adequate supply growth is becoming apparent," Goldman said in the note made available to Reuters on Tuesday.

[...]

"The possibility of $150-$200 per barrel seems increasingly likely over the next 6-24 months, though predicting the ultimate peak in oil prices as well as the remaining duration of the upcycle remains a major uncertainty," Goldman said.

If oil prices do hit $200 per barrel, we can expect gasoline prices of around $6-$8 per gallon, roughly double what they are now. And no, cutting the 18.4-cent-per-gallon federal gas tax won't accomplish anything, except to take money away from the fund that pays for highway maintenance and construction and -- according to the American Road & Transportation Builders Association, result in more than 300,000 highway-related job losses, including 6,539 in Virginia.

So, what should we be doing at this point? Slash oil consumption, slash oil consumption, slash oil consumption. Did I mention slash oil consumption? Oh, and how about a crash "Apollo program" to slash oil consumption? It's a huge undertaking, now doubt, but we've got to do it for national security, economic and environmental reasons.

As Mark Warner said yesterday, we are currently funding both sides of the "war on terror," as at least some of the money we spend on oil ends up funding the very groups that seek to attack us. Much of the rest, by the way, goes to countries that are NOT particularly our friends (e.g., Saudi Arabia, source of 15 of 19 hijackers on 9/11, not to mention Bin Laden himself). It's time to get off of our "oil addiction" now. As in, immediately. Either that, or sit back and enjoy the "super spike!" :)

P.S. Note that the Goldman Sachs analysis doesn't mention "market manipulation" or any of the other ridiculous theories I've heard mentioned out there on the campaign trail. That's because this is about a vertical supply curve combined with surging world oil demand -- Econ 101, basically. But so much more fun to talk about deep, dark conspiracies, eh?

At these prices one can wonder whether it will break the back of the economy, which would of course have the effect of reducing demand.

All this just makes me want to hop on my bicycle and ride around some more.

Still thats not something I am looking forward to

Lowell need some of your expertiese on this

What about the argument that higher oil prices makes exploration in other areas more profitable

Also this might actually be good news because if costs keep going up solar and wind make more and more sense from a cost perspective which IMHO is the true driver and not the enviromental benefits unfortunatly

Some free advice if you have been on the sidelines for energy stocks wait for the next correction (10% drop) and then buy in. I've been very fortunate to benefit and I don't see any signs of a slowdown.

By the way, gasoline prices generally track crude oil prices, although there certainly are season variations (e.g., gasoline prices are higher during peak driving periods, lower during other times). In Europe, it's different as the tax component makes up 70%-80% of the price. Here, the tax component is tiny, just 10% or so of the price depending on which state you live in.

According to some estimates there is as much oil in those tar sands as all of Saudi Arabia's reserves. And that is amount recoverable with today's technology. But ExxonMobil and Canada's Imperial Oil are always working on new ways to extract. And at these prices, a world of possibilities opens up.

There are still millions of directions we can go down the great, carbon-combustion freeway. There is a ton of carbon for as long as we want to burn it. Maybe not enough for China and India to burn as much as Americans do on a per capita basis, but still a lot. Enough to make the Earth just as toasty as Venus. Did you know that Venus is hotter than Mercury and Mercury is closer to the sun? Guess why...

But regardless of our feelings, tar sands are still being mined. And Canada has the largest reserves of them. You know where this going. They are a friendly Democracy to our North who happen to also be our largest supplier of imported energy. Why should we not exploit this for our energy needs? That will be the cry. Do you hate expensive gas that supports terrorists? Well, here is a solution! And wait, we even have some in Utah!

I feel an ad campaign coming on. Like that little girl who informed us that America has enough coal to power our economy for 500 years. "500 years is vewy, lowng time, mister!" That wasn't in the ad, but it should have been. I thought to myself when I saw it: "500 years! Well, I will be dead by then. Problem solved!" =)

Meanwhile, coal prices will continue to increase. Dominion has buffered itself against price hikes through long-term contracts with coal producers. But as those contracts expire, they will be replaced by contracts at higher prices. No one is expecting much relief in oil or natural gas prices. While alternate fuels are an option, they still are not price competitive with coal or nukes, Heacock says. "As fossil fuel costs goes up," he says, "it tilts the balance to renewable energy. But, for the most part, renewables are not competitive. Wind fuel is best. But our customers don't always use power on the same schedule as the wind blows."