The wages of conservatism: "Dollar sheds 1/3 of its value", stocks plummet, Nations Worldwide consider abandoning the Dollar

For a long time I've been referring to the Bush economy as a "Dust Bowl" economy. Why? Because, by moving trillions of dollars in wealth into the hands of a very few, this economy cuts hundreds of millions of middle-class Americans out of the prosperity and opportunity they deserve as American citizens. Thus, those millions of people have less disposable income and critical multipliers are lost to local economies. Essentially, this economy has robbed America of its economic top soil, and it has eliminated the possibility of broad, long-term growth.

While Bernanke, pundits, and analysts today point to rising gas prices, inflation fears, and the credit crunch as the causes for plummeting stock prices and the Fed's disastrous prognostication yesterday, the fundamentals have been plain to see for years, and have been widely discussed in economic circles.

Our current economic woes are the direct result of Republican mismanagement and a conservative world view that demands "If you ain't rich, you should be poor.", and "The business of America is globalization."

Way back in February, Progressive economist Hale "bondddad" Stewart identified The Five Fundamental Problems of the US Economy.

At the time he wrote:

The standard refrain regarding these points is "nothing bad has happened yet. Therefore we shouldn't worry about these things." While it is true that nothing bad has happened, we have to ask ourselves a fundamental question: "Is this the way we want to build and manage the largest economy in the world?"

Well, now plenty of bad things have happened, and it's time for Americans to wake up to the economic disaster conservatism has created for us, with no end in sight.

Here are his points and the key findings on each.

1 & 2. Debt (Public and Private):

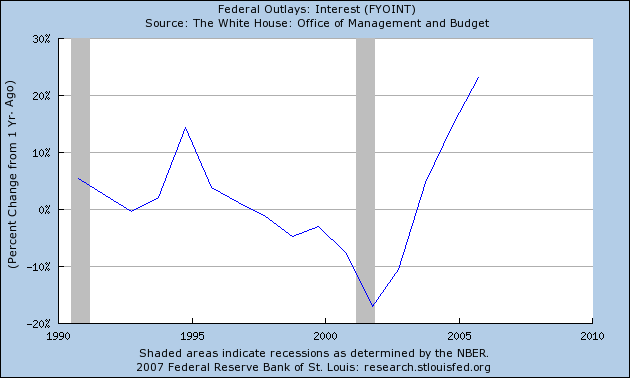

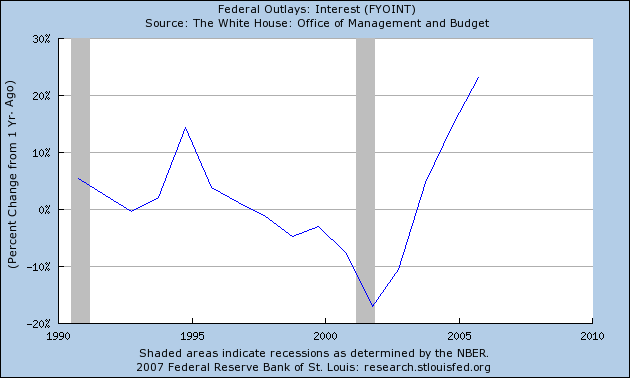

Republican mismanagement has generated the greatest debt in the history of the world, and interest payments are exploding!

According to the Treasury Department, the total debt outstanding on September 30 2001 was $5,807,463,412,200.06. That number was $8,713,570,341,089.42 as of February 12, or an increase of nearly $3 trillion dollars. The amount of interest on that debt is increasing:2006 $405,872,109,315.83

2005 $352,350,252,507.90

2004 $321,566,323,971.29

2003 $318,148,529,151.51

2002 $332,536,958,599.42

2001 $359,507,635,242.41

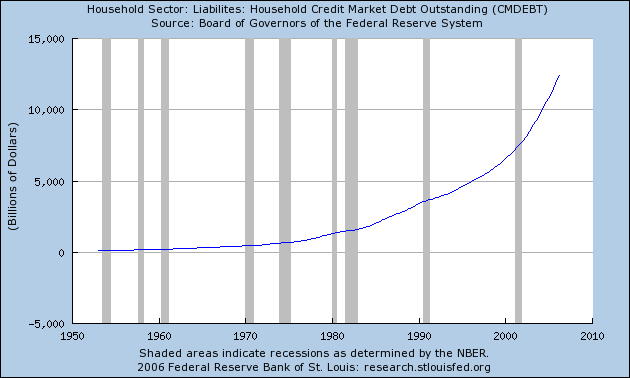

Even more astonishing is the rate of acceleration of personal, private debt:

At the heart of the credit crunch is the disastrous sub-prim lending bubble, but this was not driven by families buying new houses. The vast majority of those loans were driven by stagnant wages and growing inflation. Families had to plunder equity from their homes just to stay afloat. Thus conservatism demands: If you ain't rich, you should be poor.

Bonddad:

So, the great increase in the standard of living has not come from higher wages, but instead by borrowing today in hopes of repayment tomorrow.

3. Stagnant wages:

As quoted from the Streetlight blog:

So after accounting for consumer price inflation, the average production worker takes home about $10 more per week than he or she did in the year 2000.

Wages stagnate while productivity is at an all time high. It's a national disgrace!

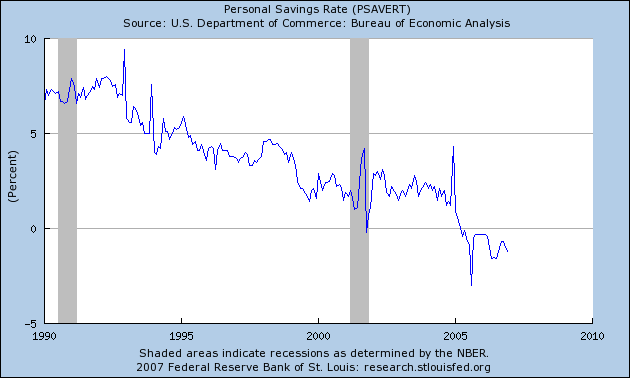

4. Negative Savings:

We ain't savin' squat! In fact, Americans have to plunder their savings in order to stay afloat.

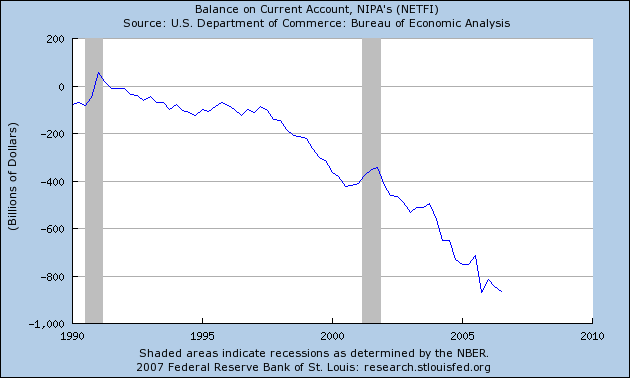

5. Trade Deficit:

And, of course, we've outsourced our entire manufacturing base forcing our entire economic focus towards FIRE sectors (Finance, Insurance, Real Estate). What's the REAL cost of that $5 t-shirt** from Wal-Mart? Possibly the entire future of the American Economy.

Bondddad summarizes thus:

So where does this leave the economy? Massively in debt and vulnerable to random events. Now we can bury our heads in the sand or try to claim that "something is fundamentally different with this current situation" that makes standard economic analysis fruitless, or we can start to change the way we conduct business.

It's tough to wrap your head around these issues, but there is a way out and it's called progressivism.

As champions of the middle-class, not just in the US but around the world, a progressive point of view is critical to reinvigorating the US economy and the hopes of the world. George Bush has created more jobs in China than Mao, and the Chinese now believe that the definition of liberty, of the American Dream is a financial definition not a moral definition.

An informed trade policy would alleviate worldwide hunger, illegal immigration, global warming, human trafficking and sweatshops besides reinvigorating and moving the world forward together into a sustainable global economy.

The economy is now the #1 issue voters will consider in 2008, beating health care, Iraq, even terrorism. It's likely that this election will again focus on the economy, stupid!. Unfortunately, while Clintonomics will address many of the disasters facing us, public debt, private debt, wages, and savings, it's unlikely that Hillary will act strongly to advance human rights, wages, and other fair trade concerns in our trade policy. In the end, this is why I am personally rooting for Jim Webb to be the Democratic VP. After 8 years of solid management and righting this foundering ship of state under Hillary, a president Webb would be able to usher in a new era of progressive economic and trade policy that would revitalize the economy of the world.

**Side Note A recent study found that 80% of the prices at Wal-Mart are HIGHER than comparable prices of similar products advertised localy.

The Conservatives like to focus on the so-called "welfare queens"--the group of undeserving poor who are taking their hard-earned tax dollars and living the good life. It's amazing to me how the Republicans have convinced so many middle-class Americans to identify and sympathize more with the wealthy than with the middle or lower-middle class, to the detriment of their own lives. It becomes an "us against them" and the taxpayers thinks they are part of "us."

We are seeing an income disparity in this country unrivaled since the Depression. The rich are getting a whole lot richer, yes, but that also means the middle class is shrinking. I do not understand how people cannot get how dangerous this is. The middle class is what made this country great; it is why America IS America. When we lose our healthy and expanding middle class, ALL AMERICANS lose.

As for Jim Webb, it always amused me how many Republican voters had convinced themselves that Webb was a DINO, secret Republican, or a conservative at heart (except for the War). I still meet people like that. I have to wonder, did any of them actually LISTEN to Jim Webb? The man never made a campaign speech without mentioning his concerns about the developing permanent underclass or his anger and frustration at the plight of the Katrina victims or the middle class squeeze. It's so puzzling to me that they could have missed that.

Or is it that they think a tough guy like Jim Webb could NEVER be a wussy progressive?

On the macro level, these were amortized into Mortgage Backed Securities, which were identified as very high quality, when in reality their underlying assets were not.

But you have to go back to the national trend where stagnant wages, and moderate inflation forced homeowners to refinance the equity out of their homes, just to make ends meet.

It's the exploding debt burden that's at the heart of the devaluation of the dollar, and remember, that devaluation directly effects the price of foreign oil and which is in turn accelerating inflation fears.

The core lesson here is that the future of a sustainable world economy depends on the expansion of the middle-class worldwide.

The more America becomes a banana republic, the farther the world slips from sustainability.

1. Agree government should do more to live within its means but alot of the deficit is due to the war

2. Personal responsibility noone was forcing anyone to take those loans

3. Wages have increased for people with the desired skill sets. Also, constant retraining is needed to remain competitive.

4. More Americans need to learn to live within their means and learn credit cards aren't candy.

5. American is a service economy and is better for it. Prices would be much higher if the manufacuturing sector was still a large part of our economy.

What are you actually proposing to fix these stiuations anyway?

Here is my solution Americans need to be smarter (both with their finances and with their education and job performance) and work harder (to remain compeitive in a global economy)

I'd say that the vast majority of us here didn't support this war but at least are willing to pay for it--so the debt doesn't get passed on to our children and grandchildren.

You want to take responsibility for something--there's a good start.

But your blanket argument against Government is no more compelling. The benefits we reap in civil society from well-managed government from roads, to courts, to utilities makes it possible for business to thrive. It's also a failed corporatist talking point.

2. Bull! Yet another failed corporatist talking point. But maybe you're right when your wages don't go up, but your expenses skyrocket (health care, education), you should just let your kids die or keep them out of college. That's great policy. Heckuva job.

3. Classic conservative elitism. "If you ain't rich, you deserve to be poor." Now you're just making my points for me.

4. This isn't about credit cards. This is about robbing the net housing equity of a nation and pouring it into the pockets of the super rich.

5. Of course we're a service economy and better for it, but this economy is based on moving all risk from the shoulders of the wealthy and on to the middle class and the poor.

I'm proposing policies that defend and support the long-team health and well being of the middle class, and remove the corporate profit incentive from the administration of critical infrastructure. Thus, universal health care and massively expanding education funding. Meanwhile, roads and utilities must be managed by the public sector and corporate socialism for the Agri-business, big coal and big oil need to roll back in favor of a farm bill that helps family farms instead of factory farms, and an energy policy focused on incentivising the end of our reliance on non-renewables.

And just some points on US Banking that facilitates a lot of these problems. I don't recall Democrats making a big fuss when they repealed Glass-Steagall (note this was after Citibank had already merged with Travellers in clear violation of the act). And Bill Clinton signed that into law. In addition, for 8 years Democrats administered the Office of the Comptroller of the Currency, the Federal Reserve and the FDIC. And did those agencies under Democratic administration do anything to make credit/lending transactions more transparent to the average person? Did they do anything to rein in the increasing push of commercial banks to expand into every area of the financial market? Did they even monitor or punish banks for their predatory lending practices (I'll grant that they took some action on some more egregious items like subsidiaries owned by Citibank)? Democrats aren't working now to pass any bills to make credit card agreements and statements more transparent.

The Public Debt points, I will grant you that Republicans created the most recent run up. But Reagan faced a Democratic congress, and they didn't balk at his massive tax cuts and massive spending bills. Even now, Democrats are not rushing to balance the federal budget. And on this one, in my mind, if you are not a part of the solution, you are a part of the problem.

On your credit points, you make completely unsubstantiated arguments that the majority of Americans had to squander their home equity or max out their credit cards to stay afloat. Of the statistics you present, none of them point to that as the reason for the run up in private debt. All of the borrowing done by US consumers has increased consumption which fueled growth under Clinton and has fueled growth under Bush. If Americans all of the sudden woke up, learned good personal financial practices, and then started implementing; then the economy would contract as people pay down their debt and stop consuming. You are making this a sob story about middle income Americans, but that isn't supported by anything you have stated. If you used home equity to buy a fancy SUV or a big screen TV or to renovate your kitchen, that isn't staying afloat. If you rack up credit card debt to live beyond your means, that isn't staying afloat. Where in this analysis is there evidence that due to stagnant real wage growth, more people cannot afford the essentials (food, water, clothing, and shelter) and they had to pull out the credit cards because of it? Are you saying that Americans were unable to tighten their belts and not buy their children that Playstation or XBOX they wanted? Because the nonessential, nice-to-have junk is flying off the shelves and that isn't all top quintile earners accounting for that activity. In fact, look around Wal-Mart, what percentage of items on the floor are really necessities?

And the trade deficit is not a Republican creation either, Democrats and Republicans were and are both riding the free trade bandwagon. It was Clinton who pushed NAFTA through Congress and signed it into law. Clinton sought and succeeded in expanding free trade with many nations and reducing tariffs with others. He was granted fast-track approval authority that gave his administration a lot of latitude in cementing those trade deals. And ultimately, manufacturing picked up and moved where it was cheapest to produce. The entire expansion of and reliance on trade goes way back before Bush and Clinton. It was the entire push of the post-WW2 world to move us away from the closed mercantile economies that facilitated the Great Depression. And even as we speak, Democrats are not lining up to pull us out of WTO or alter NAFTA.

Last on your Wal-Mart side note, that is the genius of Wal-Mart's marketing and why they grew so exponentially. Most people don't comparison shop. And Wal-Mart reels people in with teaser prices, and that's the trick that everyone falls for. They make the leap in judgment that because they saw some prices that were lower, then all prices must be lower. But my aunt who runs her own resale booth at flea markets across North Texas could have told you that years ago.

Secondly, a recent http://www.consumera...

">study estimated that less than 9% of sub-prime loans made since 1998 went to new home loans.

CRL estimates that subprime loans made during 1998-2006 have led, or will lead to a net loss of homeownership for almost one million families. In fact, the group argues, a net homeownership loss occurs in subprime loans made in every one of the last nine years.How can that be? Because, says CRL, most subprime loans are not made for the purchase of a home. They are made to refinance an existing mortgage.

The report argues that until the recent boom in housing prices, the overwhelming majority of subprime loans were refinances. Even in 2006, subprime refinance loans accounted for a majority (56%) of all subprime loans originated.

These loans were made to people who already owned homes, but who were tapping into their homes' increasing equity, while being saddled with high interest rates and risky features.

CRL estimates that since 1998, only nine percent of subprime loans have actually gone to first time home buyers. The rest went to people responding to all those TV commercials about how easy and inexpensive it is to tap into your home's equity.

So, again... that's about 9% of sub-prime loans since 1998 for new homes, the rest serving as a giant funnel to suck equity out of the middle class.

Thus the mantra of conservatism: If you ain't rich, you should be poor.

The fundamental approach to political economy must be turned in a new direction; not socialism, since the profit motive is the most effective automatic governor for a successful economy we have so far identified (which is why the communist Chinese have gleefully employed it without surrendering their political control).

As the corporations have gone global, they have removed themselves from effective oversight by nation states. As I've pointed out in the past here, I call this new organization of the world "corporate feudalism," and it is clearly a way-station on Something Else as yet unidentified. This is a window of opportunity for Progressives worldwide to re-frame the debate, bring the unaccountable greed of the impersonal corporate "persons" under control, and coincidentally save the middle class.

The desperate Third World is seeking an alternative political-economic model: sharia, pseudo-communism of Chavez, state capitalism of Russia, forced capitalist growth under state control of China... all are attempts to avoid the corrupt corporate feudalism espoused by Bush and the Republicans.